Economic Shockwaves: How the Iran-Israel Hostilities Threaten Global Markets and Regional Stability

Economic Shockwaves: How the Iran-Israel Hostilities Threaten Global Markets and Regional Stability

Introduction

Rising tensions between Iran and Israel have sparked fears of a broader conflict in the Middle East, a region already fraught with volatility. As military engagements intensify, the ripple effects are being felt not only in regional geopolitics but also across global financial and commodity markets. The threat of escalation is forcing governments, investors, and businesses to reevaluate risk exposure, with significant implications for energy prices, shipping routes, and international trade.

1. The Geopolitical Flashpoint

The Iran-Israel conflict is rooted in decades of political hostility, proxy wars, and mutual threats. What makes the current situation more perilous is the direct nature of recent attacks — including missile strikes, cyber warfare, and threats to key infrastructure. A full-scale confrontation could drag in other regional players like Hezbollah in Lebanon, and international actors including the United States and Russia, drastically destabilizing the broader Middle East.

2. Oil Markets React: Volatility Returns

One of the immediate consequences of hostilities in the Gulf is the spike in oil prices. The Strait of Hormuz — a strategic chokepoint through which over 20% of global oil passes — is once again under threat. Any disruption in supply from Iran or neighboring Gulf nations could drive crude prices above $100/barrel. This would place added inflationary pressure on global economies already navigating tight monetary conditions.

Key Data Points:

- Brent Crude futures have surged by over 12% since the conflict escalated.

- Insurance premiums for tankers operating in the Gulf have doubled.

- OPEC nations are being urged to increase output, though capacity remains tight.

3. Global Supply Chains Face New Disruptions

Beyond energy, the impact on global trade is also critical. The Persian Gulf is a vital route for shipping containers, liquified natural gas (LNG), and critical goods. Any blockade or rerouting due to security concerns would lead to higher transportation costs and longer delivery times, affecting everything from electronics to food supply chains.

- Major risk zones: Strait of Hormuz, Bab el-Mandeb Strait, Suez Canal proximity.

- Affected sectors: Manufacturing, agriculture, tech components, automotive.

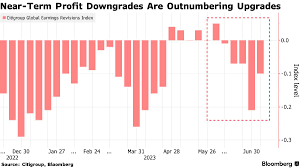

4. Investor Sentiment and Market Shock

Financial markets have responded with classic risk-aversion behavior:

- Gold prices surged past $2,400/oz, hitting new highs.

- Global stock indices posted weekly declines, particularly in emerging markets.

- Capital is flowing into safe-haven currencies like the USD and Swiss Franc.

Investors are closely watching for signs of diplomatic mediation. The longer the uncertainty, the higher the capital flight from risk-heavy assets like equities and high-yield bonds.

5. Regional Stability in Jeopardy

From Lebanon to the Gulf States, the Iran-Israel conflict risks triggering widespread instability:

- Lebanon faces renewed violence as Hezbollah threatens retaliation.

- Gulf nations are reinforcing air defenses and pushing for regional summits.

- Iraq and Syria, already destabilized by other conflicts, risk becoming battlegrounds for proxy escalation.

Economically, tourism, foreign direct investment (FDI), and infrastructure development projects in the region are likely to be delayed or canceled due to rising security risks.

6. Diplomatic and Strategic Responses

World powers are attempting to de-escalate tensions:

- The UN Security Council held an emergency session, urging restraint.

- Backchannel talks reportedly underway between US and Iranian officials.

- China and the EU are calling for a neutral corridor for oil transport through the Gulf.

However, with hardliners gaining traction in both Iran and Israel, the path to de-escalation remains uncertain.

Conclusion: A Global Crossroads

The Iran-Israel hostilities are more than a regional crisis — they are a potential catalyst for global economic turbulence. With supply chains, energy prices, and financial markets hanging in the balance, the international community faces a critical test of diplomacy and resilience. Whether cooler heads prevail will determine not just the fate of the Middle East, but also the economic trajectory of the world in the months to come.

League Manager Editorial Team

Leave a Comment